If your daily balance is more than $50,000 the interest rate paid on the entire balance in your account will be 4.16% with an annual percentage yield of 4.25%. The rate of return for his investments is considered to be 12 p.a. If youre living by yourself and you work in a high demand job, you can err closer to 3 months. If your daily balance is more than $10,000 but $50,000 or less the interest rate paid on the entire balance in your account will be 4.16% with an annual percentage yield of 4.25%. The standard time frame for an emergency fund is 6 months of essential monthly expenses. If your daily balance is more than $2,500 but $10,000 or less the interest rate paid on the entire balance in your account will be 4.16% with an annual percentage yield of 4.25%. Using this calculator Use this calculator to estimate how much money.

The ongoing APYs and Interest Rates associated with different account balances are: If your daily balance is more than $0 but $2,500 or less the interest rate paid on the entire balance in your account will be 4.16% with an annual percentage yield of 4.25%.

6 MONTHS LIVING EXPENSES CALCULATOR PLUS

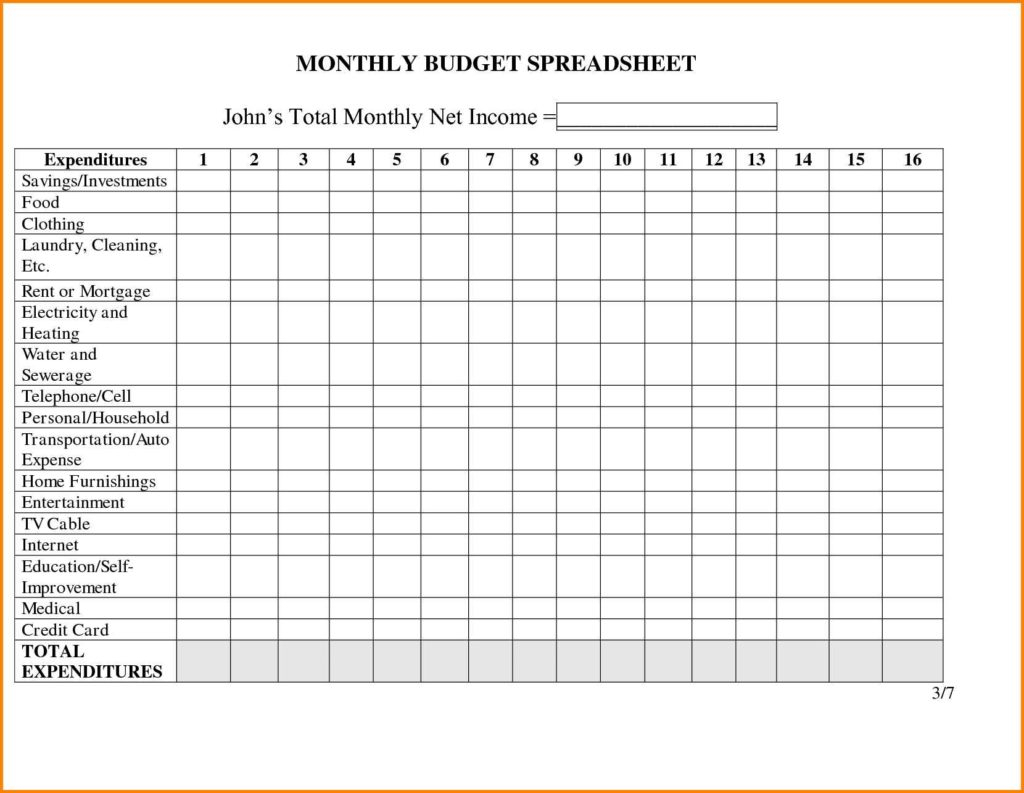

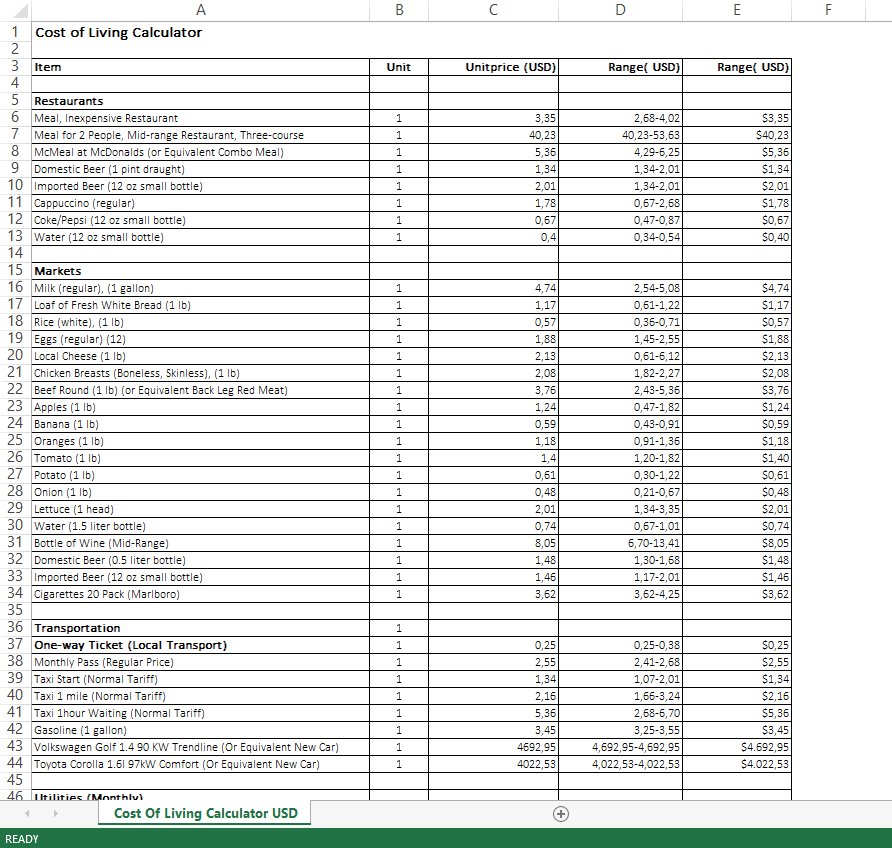

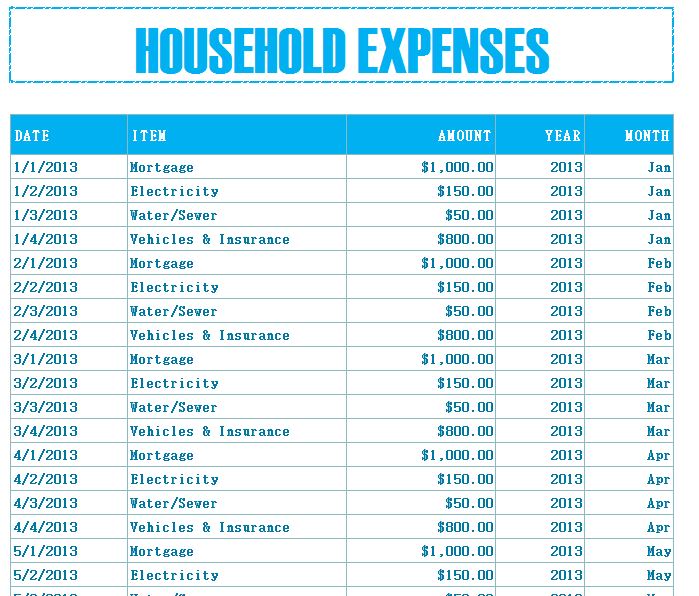

Use the emergency fund calculator to quickly get the same result.SmartyPig Accounts are offered through Sallie Mae Bank, Member FDIC.ġAdvertised Interest Rates and Annual Percentage Yields (APY) for the SmartyPig Account are variable and may change after account opening, are based on your aggregate account balance on all your SmartyPig goals (including your Primary Account) plus your month to date accrued interest which may not have yet posted to your account, apply to personal accounts only, and are accurate as of. Summary of cost of living in Netherlands Monthly rent for 85 m2 (900 sqft) furnished accommodation in normal area, 1,714 Utilities 1 month (heating. Thus, the emergency fund needed for Cindy is $2,500 * 6 = $15,000. The last step is to calculate the emergency fund amount, which can be achieved by using the formula below:Įmergency fund = monthly expense * number of months In Cindy's case, she would like to have 6 months of savings.Ĭalculate the emergency fund amount needed: The family you live with will provide you with a bedroom, pay all the utility bills, and make your daily meals. College cost increase rate: 5 recommended. You can’t use the investment money for your start-up business to cover your living expenses. In some cases, the designated organization may give you additional money to help cover your living expenses. However, it is usually recommended to have at least 3 to 6 months of savings. This calculator is mainly intended for use in the U.S. The amount of money you need depends on how many family members will be coming with you. This is solely based on your risk appetite and personal circumstance. The next step is to determine the number of months of savings for your monthly expenses that you need. The average American consumer spends roughly 61,334 a year or roughly 5,111 a month on all expenses. That way, you’ll be able to handle it if something unforeseen happens. For Cindy, her monthly expenses is $2,500.ĭetermine the number of months of saving you desired: It’s generally a good idea to have enough money set aside to cover three to six months of living expenses. The first step is to understand your monthly expenses. Calculate your allowable expenses using a flat rate based on the hours you work from home each month. You can calculate the emergency fund amount in three steps:ĭetermine the amount of money you usually spend on your monthly expenses: To understand how much emergency fund you need, let's take Cindy as an example:

0 kommentar(er)

0 kommentar(er)